Weather is like a jester, in Italy. The North is fighting against drought, while the Centre and the South are experiencing strong and persistent rains and snowfalls. In the coming days, temperatures are expected to rise, with snow present only at high altitudes and strong winds, especially in the islands.

The last weeks’ frost wave is still affecting Central-southern regions. In the horticultural sector, seasonal fruit and vegetables are down 50%. The surviving quantities are sold at high prices in Italian markets.

Coldiretti points out, “In the southern countryside, the sub-zero temperatures damaged winter crops such as artichokes, fennels, celery, parsley, cabbages, Savoy cabbages, chicory and broccoli. The climatic anomaly hit Morocco, Egypt, Turkey, the Netherlands and Spain as well. In the latter, almost 300 artichokes, lettuce and broccoli hectares were destroyed.

According to the latest Italian telematic goods exchange (Bmti), fennel price is 1.80 euros/kg, nowadays. Same thing for the cauliflower which is sold for 1.60 euros. The Italian lettuce price is even doubled: from less than 1 euro to 2.20 euros. Italian green beans could not handle the unforgiving temperatures and they have been substituted with produce coming from North Africa.

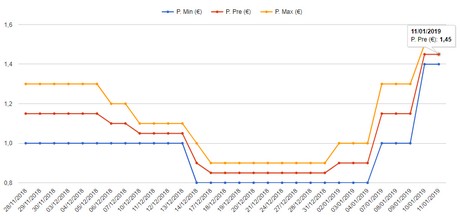

As the graph above illustrates, first category Italian white cauliflower packaged in 8-pieces boxes (40x60) went from 0.85 euros/kg (as of 31 December) to 1.45 euros/kg (as of 11 January 2019), at the Turin’s Caat.

Frost did not spare greenhouse crops either. In order to save the vegetables, farmers had to face high costs to keep the structures heated. As a consequence, the leftover aubergine and tomatoes are marketed at almost 3 euros/kg.

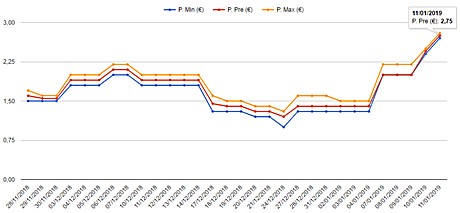

As the graph above shows, first category Sicilian aubergine went from 1.40 euros/kg (as of 31 December) to 2.75 euros/kg (as of 11 January 2019), always at the Turin’s Caat.

In Tuscany, the artichoke harvest will be halved

Last week’s frosty nights and incredibly low temperatures enormously affected Tuscany’s horticultural production, especially for those artichokes farmed in the internal areas where the temperatures reached the -10 degrees.

In these areas, frosts damaged plants and halved the artichoke harvest. The other problem caused by these climatic conditions is the slow-growth for winter crops such as spinach, beets, turnips, Savoy cabbage and cabbage.

The fruit is safe

On the other hand, Italian fruit was not affected by this winter weather. Apples, pears and kiwis were harvested before the bad weather hit. Citrus fruits and clementine are stable, as well.

Source - https://www.freshplaza.com

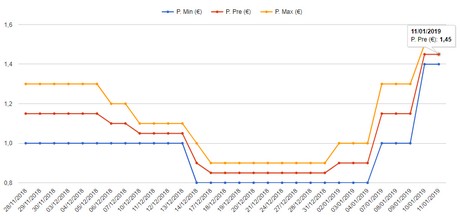

As the graph above illustrates, first category Italian white cauliflower packaged in 8-pieces boxes (40x60) went from 0.85 euros/kg (as of 31 December) to 1.45 euros/kg (as of 11 January 2019), at the Turin’s Caat.

Frost did not spare greenhouse crops either. In order to save the vegetables, farmers had to face high costs to keep the structures heated. As a consequence, the leftover aubergine and tomatoes are marketed at almost 3 euros/kg.

As the graph above illustrates, first category Italian white cauliflower packaged in 8-pieces boxes (40x60) went from 0.85 euros/kg (as of 31 December) to 1.45 euros/kg (as of 11 January 2019), at the Turin’s Caat.

Frost did not spare greenhouse crops either. In order to save the vegetables, farmers had to face high costs to keep the structures heated. As a consequence, the leftover aubergine and tomatoes are marketed at almost 3 euros/kg.

As the graph above shows, first category Sicilian aubergine went from 1.40 euros/kg (as of 31 December) to 2.75 euros/kg (as of 11 January 2019), always at the Turin’s Caat.

In Tuscany, the artichoke harvest will be halved

Last week’s frosty nights and incredibly low temperatures enormously affected Tuscany’s horticultural production, especially for those artichokes farmed in the internal areas where the temperatures reached the -10 degrees.

In these areas, frosts damaged plants and halved the artichoke harvest. The other problem caused by these climatic conditions is the slow-growth for winter crops such as spinach, beets, turnips, Savoy cabbage and cabbage.

The fruit is safe

On the other hand, Italian fruit was not affected by this winter weather. Apples, pears and kiwis were harvested before the bad weather hit. Citrus fruits and clementine are stable, as well.

Source - https://www.freshplaza.com

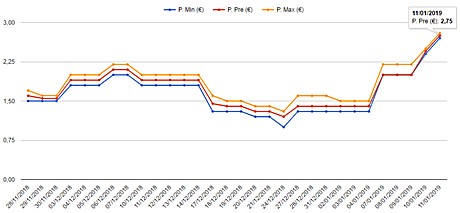

As the graph above shows, first category Sicilian aubergine went from 1.40 euros/kg (as of 31 December) to 2.75 euros/kg (as of 11 January 2019), always at the Turin’s Caat.

In Tuscany, the artichoke harvest will be halved

Last week’s frosty nights and incredibly low temperatures enormously affected Tuscany’s horticultural production, especially for those artichokes farmed in the internal areas where the temperatures reached the -10 degrees.

In these areas, frosts damaged plants and halved the artichoke harvest. The other problem caused by these climatic conditions is the slow-growth for winter crops such as spinach, beets, turnips, Savoy cabbage and cabbage.

The fruit is safe

On the other hand, Italian fruit was not affected by this winter weather. Apples, pears and kiwis were harvested before the bad weather hit. Citrus fruits and clementine are stable, as well.

Source - https://www.freshplaza.com